What's in my wallet?

The Credit Card Issue for Q1/Q2 2022

In the shadow of what’s currently happening in Ukraine, I’ll be the first to acknowledge that my ramblings on personal finance aren’t meant to be a distraction from significant news stories. Instead, I’m just doing my best to share what I’ve learned and hope it can be helpful for your journey towards financial freedom. My heart goes out to the Ukrainian people, and all others impacted by war. Life is difficult enough, we should do everything we can to avoid conflicts like this.

Welcome to the 2 new Thinkers who joined Thinking Cap(ital), thanks for continuing to share this with friends, we’re now 143 strong 💪

Credit card vloggers have no shortage of commentary and recommendations on the latest and greatest in their worlds. What they understand that most people neglect is that credit card points, airline miles, and hotel loyalty programs are their own form of currency. These currencies are subject to their own fluctuations. From the positive partnership expansions and sweet spots, to the negative point devaluations or program overhauls.

My goal today is to give you a small taste of how you can use the money you’re already spending to unlock luxury experiences that you may not want to pay for out of pocket. My bias here is exactly that. I’m not optimizing for cash back or gift cards, I’m optimizing for points that can be redeemed for business and first class flights or hotel upgrades. If you’re not interested, skip this issue, otherwise let’s open up my wallet and speak to each card within it.

What’s in my wallet?

At one point in my life I had 9 credit cards, and today I hold 7. It’s a far cry from a friends with 13, and the 20 held by Brian Kelly aka The Points Guy. Before I get ahead of myself, any discussion of credit cards should start with these three warnings:

No card is worth the APR charged, always pay your bill in full each month.

Try your best to keep the longest tenured card around, since that impacts your credit score.

If you no longer need a card, it’s always worth calling for a retention offer, and if that cannot be provided, then asking for a downgrade to a no annual fee card.

With that said, let’s get into it. I keep 4 cards in my wallet and 3 stored in my password manager for online shopping:

Everyday Cards:

Amex Platinum

Amex Bonvoy Brilliant

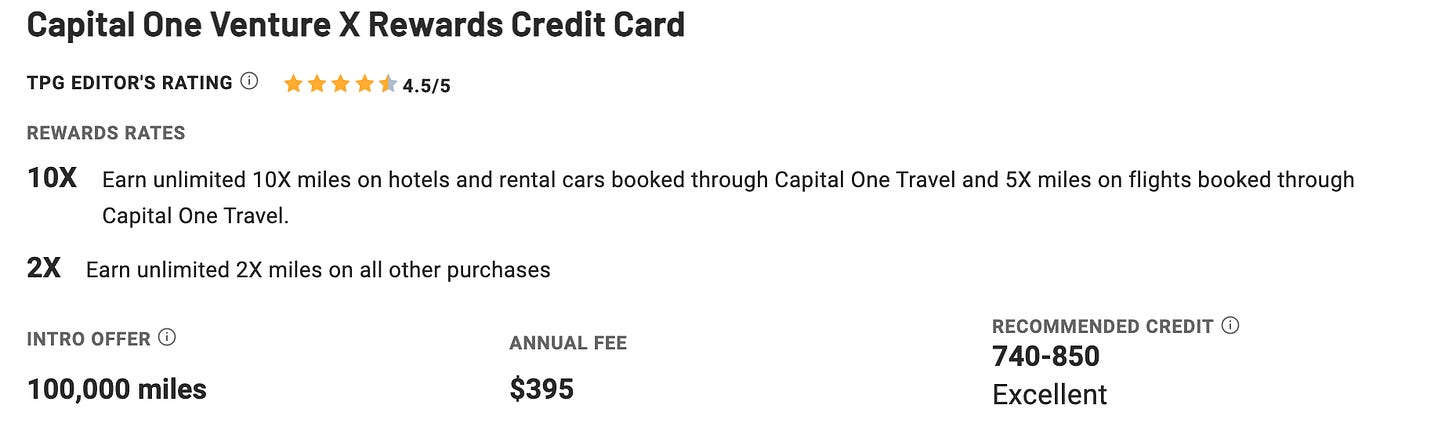

Capital One Venture X

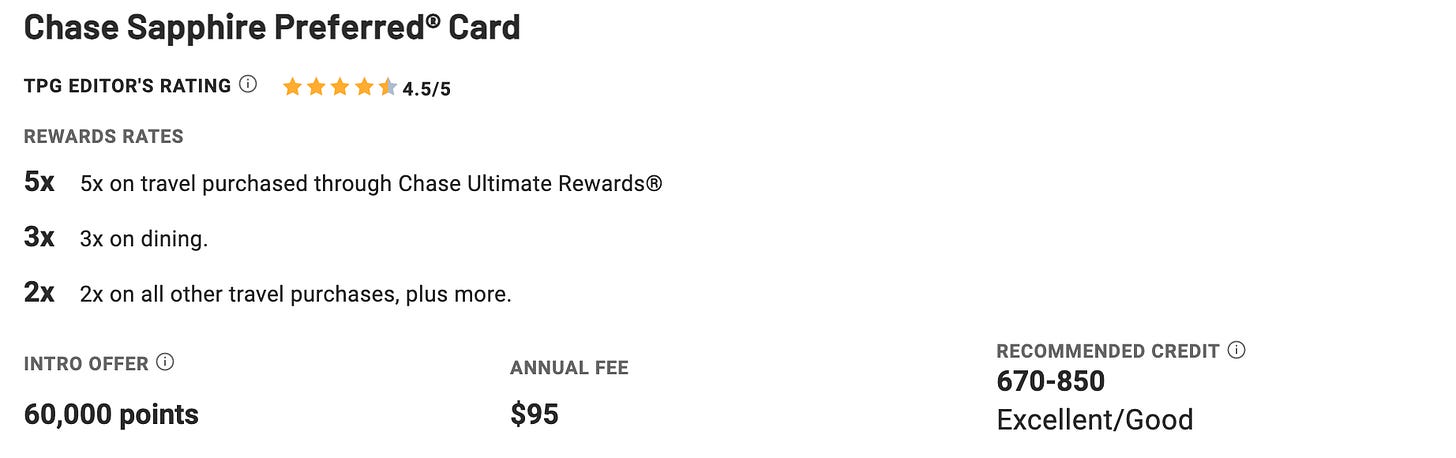

Chase Sapphire Preferred

Online Shopping & Downgrade Cards:

Amazon Card, earns 5% cash back if you have prime with no annual fee. This is likely worthwhile for Amazon Prime with significant spend in categories that aren’t high earning from other cards. I was attracted to this card for real estate renovations, in short, Amazon open-box is a great way to save money and support the environment when purchasing everything from light fixtures to kitchen faucets. In my experience most items are like new despite “good to very good” condition notes.

Chase Freedom, this was a downgrade from my first Chase Sapphire Preferred card, when it first debuted. This card offers a rotating quarterly 5% category, for instance this quarter is eBay and Grocery Stores for up to $1,500 of combines spend. 5% is fantastic, and eBay can often be paired with Rakuten for additional cash back, sometimes netting over 10% combined.

Chase Freedom Unlimited, this was a downgrade from my Chase Sapphire Reserve card. You can only have one Sapphire card at a time and Chase is very strict about timing, only allowing one Sapphire welcome bonus every 48 months. The Unlimited offers 5% on Travel booked via Chase Travel Portal and 3% at Restaurants & Drugstores. I only use it for online drugstore purchases and to pay a monthly bill in order to keep it active.

Okay, let’s move onto the fun cards with a little background on each:

Amex Platinum, unlike other card providers, Amex allows you to upgrade between cards. I opened a Gold Card for its amazing 4% back on groceries and dining and was targeted with a 60k upgrade offer to switch to Platinum. While the day to day bonus points are easier to accrue on a Gold card, you’re welcome to have both, but instead I opted for Platinum for a few key reasons:

Centurion Lounge Access, these are hands down the best lounges I’ve been to

5% back on flights, while other cards offer this, the catch is that you typically have to book through a travel portal. With the Platinum card, you’re able to book directly with the airline.

Amex Offers, while it can sometimes feel like a coupon book, there’s the occasional offer that I cannot pass up, like $50 off a $50 purchase at Home Depot, or a similar $50 offer for Best Buy. As well as offers for services I already pay for, and can now receive a $15 per month credit for Audible, Uber and Walmart Plus.

The annual fee is now a whopping $695, but if you’re a frequent flyer with a Centurion Lounge at your local airport, I think it’s worth it. They’re currently offering a 100k sign-up bonus, but it may be worth holding out for a better offer, as that can fluctuate up a bit more. If you’d like to support me, here’s a referral link.

Amex Bonvoy Brilliant, this card was a lot more useful to when work travel was still a thing. While I’m still quite the loyal Marriott customer, I wouldn’t necessarily recommend attempting hotel loyalty tiers for anyone spending less than 30 nights a year in hotel rooms. If you’re doing 30+ nights, the next step is to determine the price differential between one of the major chains versus where you typically stay, as it can erode the benefits of loyalty.

Ultimately this card is $450 a year and includes $300 cash back on purchases at Marriott (including stays) and an annual free night award worth up 50k points (a very nice night in most cities and a mid-tier stay in major cities like NY, SF & Tokyo). Referral link here.

Capital One Venture X, this hot card at the moment. CapOne came in like a wrecking ball with a 100k welcome offer, and $395 fee that easily pays for itself with $300 cash back on travel portal, $200 vacation rental credit (Airbnb/VRBO), Priority Pass Lounge access, Global Entry and a 10k points anniversary bonus. If you utilize all of these bonuses, you’re netting at least $700 in value and if you use the 100k points to book a business class flight like my upcoming Emirates JFK-MXP RT, you’re receiving another $3000 in value.

This is my top pick for folk with great credit, as long as you have $6,000 in upcoming spend over the next 6 months to redeem the bonus offer. Here’s a referral link.

Chase Sapphire Preferred, if your credit score doesn’t qualify you for the Venture X or the spend threshold feels a little heavy, than I’d recommend the Sapphire Preferred. While you just missed the 100k welcome offer from 2021, this card is still a great intro to the world of points. The spend requirement is still $4,000 in the first 3 months, but if you have a large purchase you can plan around that. For the $95 annual fee you’ll receive $50 in credit on the Chase Travel Portal and DoorDash DashPass. Not the best offer, but there is a clear downgrade path if you’re unhappy with the services after your first year.

Your mission, should you choose to accept it is to take a moment to think about your credit card strategy.

Do you have one? If not, now is a great time to give it some thought. As COVID restrictions start loosening, it’s exciting to start planning for a trip and even more exciting to book that trip with Airline Miles since those reservations have way more flexibility than a standard cash ticket would.

I love nerding out about this, so feel free to reply with any questions and I’ll recap any good ones in the next issue.

Until next week!

Armand