The Pros & Cons of an HSA

Beginner vs Boss Modes

Welcome 34 new Thinkers, we’re now 179 strong 💪

Good morning, this is Thinking Capital. A weekly mission for you to optimize all aspects of your financial life. Today’s mission: HSAs

Did a friend forward this to you, if so you can subscribe here:

A few years ago, I made the switch from a traditional US health insurance plan to a high deductible plan combined with a HSA (Health Savings Account). Every year, job change, or qualifying life event is a chance to question that decision and ensure it’s still the right choice for you. Today, I’d like to talk through some of the benefits of HSAs and why I’ve choose that route.

Before we get into it, health care is just as (if not more) tricky than investing and financial services. What’s right for me isn’t necessarily right for you. Instead, take this as opportunity to learn what else is out there, so you can make better decisions for yourself and/or family.

So what is an HSA?

An HSA is an account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. It can only be paired with a HDHP (high deductible health plan).

Like an FSA?

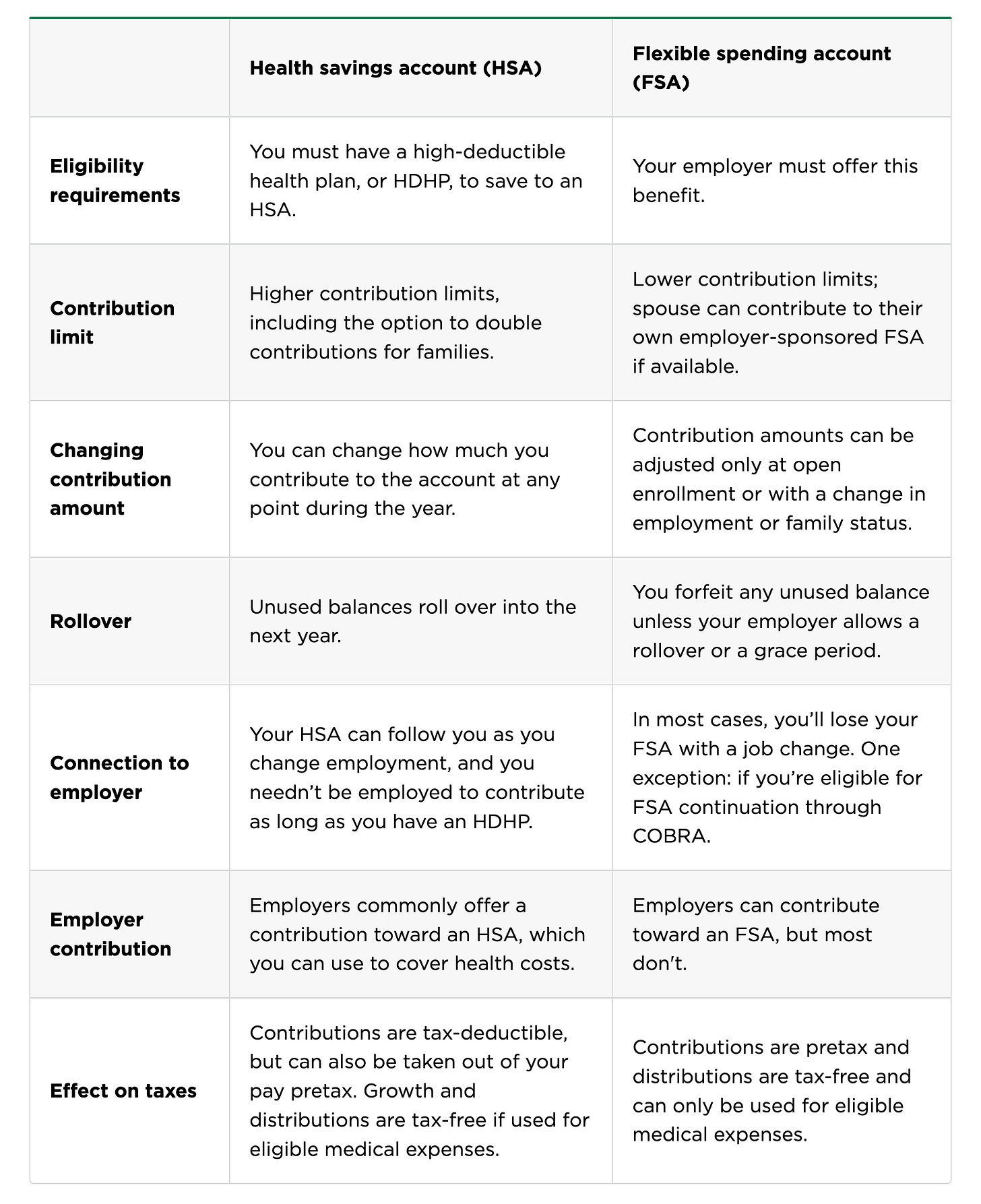

Sort of. Yes, in terms of what you can spend the funds, but there are a number of differences. This chart from NerdWallet compares them well:

TL;DR: Why HSA?

It all makes sense when you see the Boss Mode HSA Strategy, but let’s start with Beginner Mode:

Opt for HDHP + HSA, especially if your employer contributes to your HSA

If you can afford it, max out your HSA

Individuals can contribute up to $3,650 this year; while families have a max contribution of $7,300

For those 55+, you can add a $1,000 catch up contribution

These funds are contributed pre-tax and removed from your income for tax purposes

As expenses come up, you can choose to pay for them with these pre-tax funds. Unlike an FSA, there’s no rush to use the funds, you can carry these for the rest of your life, which leads to Boss Mode…

The Boss Mode HSA Strategy

Opt in for HDHP + HSA

Max out annual contributions

Invest your funds for pre-tax upside

Akin to a 401k, HSAs allow you to invest those idle cash contributions into the market, I typically opt for a low-cost S&P 500 Index, but that’s not financial advice

Despite being able to invest, only 6% of HSA participants opt-in. Everyone’s financial situation is different, but if you have rainy-day funds for emergency medical expenses, than you can always pay out of pocket

In fact, I always pay out of pocket. An HSA provides you with a debit card, that I don’t even activate. I rather pay out of pocket on a credit card and hold onto the receipt.

Two birds with one stone: accrue points, maintain growth of pre-tax index funds!

This is crazy, but I send the receipts to an email folder and plan to expense them down the road. Specifically when I’m 65.

Why 65? At 65 years old your HSA unlocks. You can deduct all the medical expenses from now until that time, and then you can pay ordinary income tax on any additional funds you’d like to withdraw. I imagine my tax bracket being lower in retirement, so I’m happy to wait.

Your not limited to using the funds for yourself either, you can use them for any tax-dependent.

There you have it, the boss mode strategy. While many of you will laugh at how long term minded it is, I fund solace in small actions I can take now to benefit my future self and family.

Your mission, should you choose to accept it is to reconsider your current health plan and whether it’s still the best option for you.

Until next Thursday!

Armand