The Average American Needs $1M to Retire

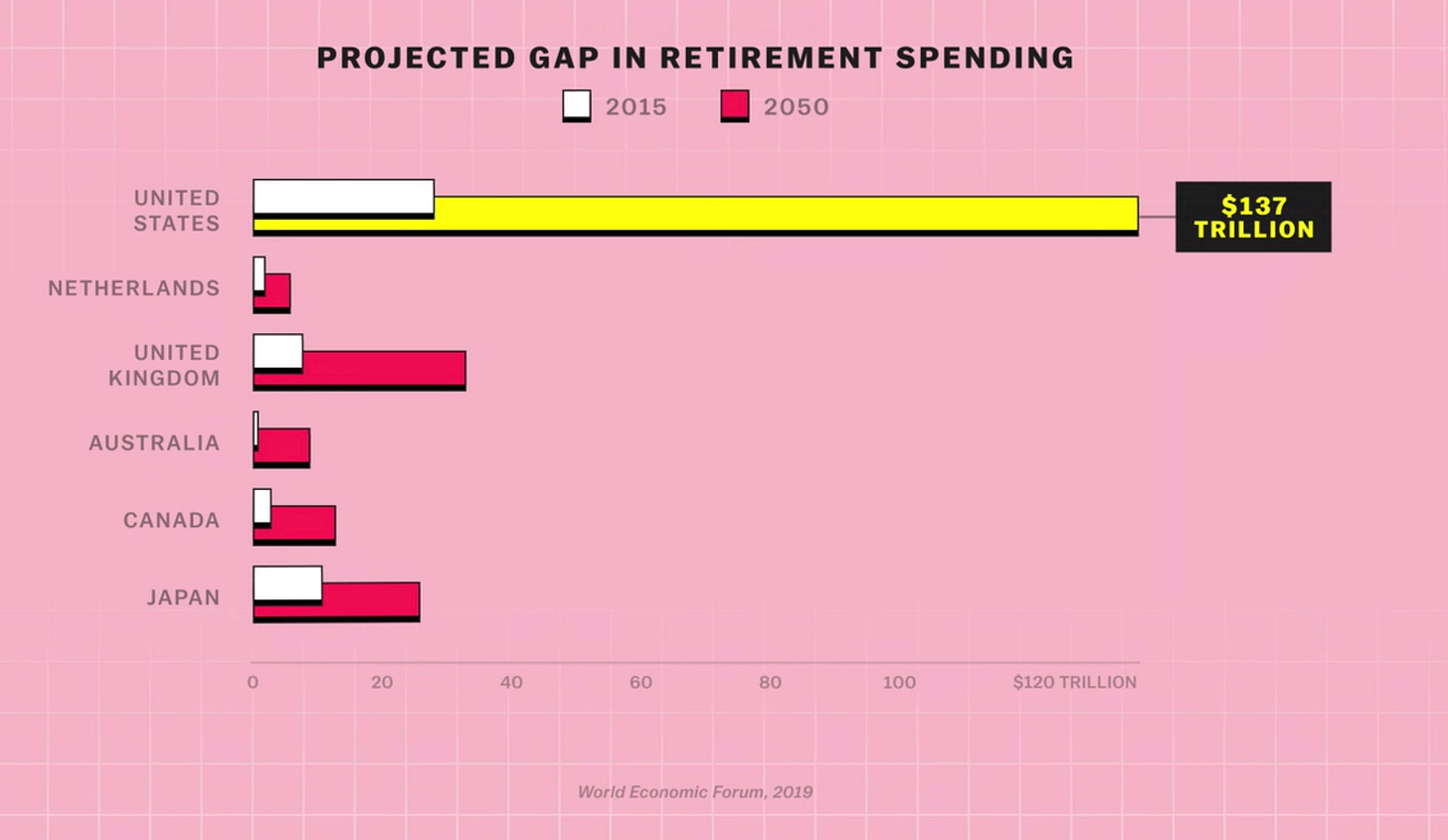

Millennials have a $137 Trillion retirement gap, let's change that!

Welcome to the 21 new Thinkers who joined ThinkingCap, thanks for continuing to share this with friends, we’re now 82 strong. Share ThinkingCap here.

We’re just shy of 2 weeks into the new year. Take a moment to check in with your resolutions and reassess whether or not you’re still committed to them. Instead of ditching them, perhaps make them more actionable with smaller steps towards your ultimate goal.

In 2011, Stanford researchers wanted to measure brain waves when volunteers thought of themselves now and in the future. In order to create a control, they measured four scenarios:

Yourself now

A stranger now

A stranger 10 years from now

Yourself 10 years from now

Despite our brains lighting up with activity when we think of ourselves now, most people had just as little activity for their future selves as they showed for a stranger.

What does this tell us?

It’s difficult for us to take our future selves into account, whether that’s planning new years resolutions or planning for retirement. That difficulty is showing in the numbers, with a US Retirement Savings Deficit of $137 Trillion.

By now, you may be asking yourself how much money you (and perhaps your parents) need for retirement and how to get there. We can start by revisiting the last note and calculating your budget.

Our budget gives us three key ingredients:

Annual Income

Annual Investments

Annual Expenses

Beyond those, we’ll need two more numbers:

Total savings (cash)

Total portfolio (investments)

Once we have our numbers gathered, we can plug them into this Retirement Calculator. If we use our sample numbers and assume a $100k investment portfolio, we can retire in 7.5 years, with a phenomenal savings rate of 72%, 12x higher than the US National Average of 6%

These numbers are not easily achievable, hence they’re a fictitious sample, but the key insight is that Savings Rate > Return on Investment. It’s tempting to time the market or try your hand at risky investment strategies, but it’s much more important to curb what’s in your realm of control — spending.

Your mission, should you choose to accept it is to calculate your Retirement Date.

Plug in your numbers

Take a screenshot

Add a new tab to your Budget and upload that screenshot with today’s date

Now you have a baseline

From here, you should take some time and think about your future self. What will life look like? Where will you be living? Who else will be in your life? These questions will help you equip your future self.

I know, this is heavy.

I’ve take Strengths Finder three times at various stages in my career and “Futuristic” has always been a top 2 strength. I acknowledge that my excitement for the future, may be your discomfort. That said, you know me and I’m always happy to help, so don’t hesitate to reply if/when you get stuck and we can navigate together.

✨ Extra Credit

Netflix Explained has a great episode on Retirement, for the uninitiated, Explained is one of my favorite series, taking complex topics and distilling them into 20 minute episodes with record-breaking “insights per minute.” Check it out here.

Mr. Money Mustache talks through early retirement and drives home the point that savings rate is paramount here.

If you’re still hungry for more, you should dig into your annual expenses. Chances are it’s not the lattes or avocado toast preventing your from meeting your retirement goals, it’s very likely the much larger expenses, with housing being number one for most of us. Instead of fretting over the small stuff, think about housing, autos, and other large expenses and ask if they’re still delivering outsized returns to your happiness.

A slight diversion…

For those interested in cryptocurrency, I’ll be following the development of alternative smart contract Layer-1’s (other blockchains that have the ability to compete with Ethereum). I don’t think Ethereum is going to disappear, I just think that we’ll see more growth in these alternative ecosystems as developers determine which L1 is best for their protocols.

Until next Thursday!

<$ Armand