Strategies for Large Purchases

And what Snoop Dogg's latest purchase says about the creator economy

Welcome to the 16 new Thinkers who joined Thinking Cap(ital), thanks for continuing to share this with friends, we’re now 141 strong 💪

Valentine’s Day is around the corner and for some people that may mean a large purchase for your significant other, or perhaps even an engagement ring. Today I wanted to share my strategies for ALL large purchases to help you ensure you’re getting the most out of your spend.

We’ll cover the following:

Tech-enhanced comparison shopping

Credit vs cash

Tax considerations

Strap your seatbelt on, this one is insight packed. Before we get going, it’s important for me to share that while many big purchases are inevitable, every purchase decision should start with a simple question: Do I really NEED this?

If you’re not sure, then the answer is likely no. That doesn’t mean you shouldn’t buy it, but you should always check in with yourself to make sure you’re not buying something as a reaction to an emotion. That emotion is temporary, but your purchase is permanent.

Tech-enhanced comparison shopping

If you know exactly what you want, and it’s only available from one specific store then this won’t be helpful. If it’s not a specific item from a specific store, then keep reading. There are two tools that have saved me thousands of dollars while shopping:

Pinterest

Rakuten

Let’s talk about each.

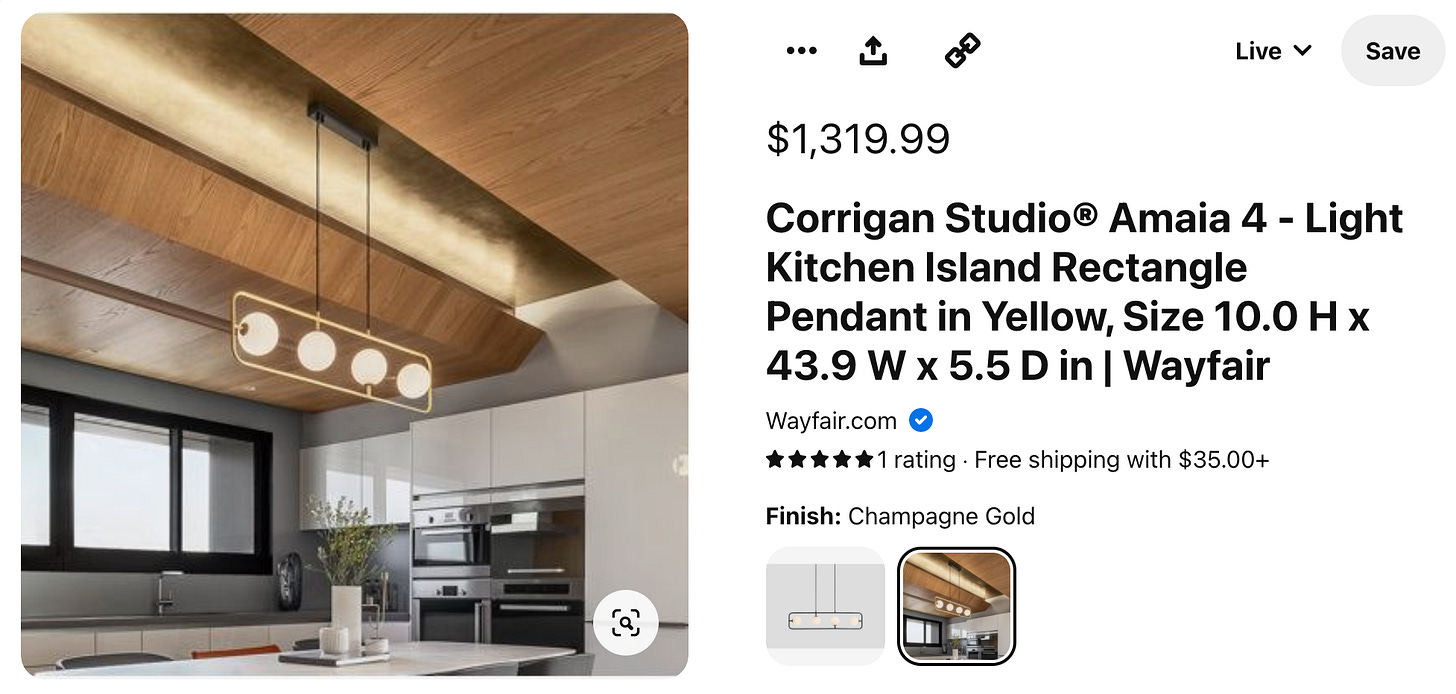

Within Pinterest (yes, my employer), there’s a small magnifying glass icon on the bottom right of every Pin. If you click it, Pinterest will try to identify specific objects within the image and allow you to click them to see similar products. This has been invaluable to me for both home and rental property renovations. If I’m traveling or even at a friends place and see anything from a light fixture to a sink to a non-household good, like a pair of shoes that I really like, I can use Pinterest to find alternative styles and alternative prices.

For instance, this light fixture from Wayfair. $1,300 may be a great deal for you or it may be outside of your budget… clicking the magnifying glass will yield similar items to appease any style, space or budget.

Rakuten, on the other hand, isn’t for the inspiration-phase of shopping. Once you’ve narrowed down on an item, it does however, help ensure you’re getting the best possible price when accounting for the cash back they offer. While Rakuten is one of many cash back rewards websites, it’s my favorite due to it’s widespread adoption as well as the lesser-known ability to opt for American Express Memberships Rewards points instead of cash back.

That’s right, for each penny you would have received as cash back, you can instead receive one Membership Rewards point. During a later issue, I’ll speak to additional Rich Life Goals and how I can turn Membership Rewards points into ~10+ cents in value, but for now you can start stacking and support this newsletter through this Rakuten sign-up link. If you’d like to opt into points instead of cash back, you can learn how to do that here.

Credit vs cash

Ok, you’ve found your item and you’re ready to buy it. If you’re using Rakuten, you’ll have to use a credit or debit card to qualify for their bonus, but if this is a very big purchase many merchants will entice you to use cash with either a discount or a processing fee of 2-3%. While it may feel sketchy, there are costs associated for merchants to process credit card payments, but it may be worth eating the fee, especially if you have a more premium credit card like:

American Express Platinum / Gold

Chase Sapphire Reserve / Preferred

Capital One Venture X

All of these cards have annual fees, but with those annual fees come benefits that cash won’t provide. For instance:

Purchase protection, a 90-120 day warranty in case your item is broken, lost or stolen

Price protection, a rebate if your item drops in price within 90-120 days

Warranty match, matching an manufacturers warranty up to one year

While many cards have these features, they’re not the easiest to use, but can be well worth the hassle if a large purchase goes missing or is deeply discounted soon after receiving it. Price protection worked wonders for a friend of mine after he bought us groomsmen dress shoes for his wedding and then they significantly dropped in price soon after. It’s also helped alleviate the fear of traveling with a brand new camera lens to an unfamiliar place. Ultimately, these are all credit cards and if you don’t have the cash in the bank to pay your full balance immediately, then don’t even think about it. At a time when savings accounts yield less than 0.05% these cards will charge interest upwards of 25%, so make sure you have a healthy grasp on your spending before trying to game the system.

So when should you avoid using a credit card?

If a large purchase is an event or experience, and isn’t refundable, then it’s worth considering cash, but I find it’s very rarely worth it. Again, assuming you have very good to great credit and you’re in market for another credit card, I would much rather take on another card with a spectacular sign-up bonus and a justifiable annual fee, like the Capital One Venture X card (referral link). The Venture X currently offers 100,000 points after spending $10,000 in the first 6 months. If you’re planning a $10,000 party (sounds fun!) and you’re charged a 2% credit card fee of $200, you’re still unlocking at least $1,000 worth of points. In a future issue I’ll share how to turn 100k points into over $10,000 in value. Point being, I think it’s worth going the card route.

Tax considerations

Last, but not least tax considerations. As a NY resident, I’m accustomed to the 8.25% sales tax added to most goods, so if there’s a high-ticket item that’s easily portable, it’s worth waiting until you’re in a more favorable sales tax state. Five states currently have no sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. It may not be worth crossing state lines for a new jacket, but if that jacket is a speciality ski jacket and you’re about to go skiing at Mount Hood, it may be worth getting a price match at a local store and putting down a deposit before arriving to complete the payment and pick it up.

For larger purchases like jewelry, or other luxury items, it may even be worth taking a trip to a nearby state without sales tax and having the items shipped to your hotel or rental property. While the cost of the trip may be almost as expensive as the savings, it’s still an experience you may have otherwise not afforded.

So let’s recap

Tech-enhanced comparison shopping

Comparison shop with Pinterest

Enable cash or points back with Rakuten

Credit vs cash

Check if your current card offers protections

Work towards a minimum spend bonus offer for a new card

Tax considerations

Weigh pros and cons of traveling to another state to save on sales tax

What else would you add to this list? In a future issue I’ll share an overview of the credit cards I use on a day to day basis and the minimum spend offers I’m working on or am planning to tackle.

A slight diversion…

Snoop Dogg just acquired his original record label, Death Row Records (source). Just after it’s 30 year anniversary, it’s now back in the hands of one of it’s creators and I think this is not only positive for Snoop, but also a big win for the broader creator economy.

Snoop is no stranger to creator ownership and the contemporary smart contract royalties offered by web3. He’s partnered with Sandbox, amassed a significant NFT collection and even claims that he is one of the most prominent NFT collectors on crypto Twitter:

Through full rights of his older songbook, he’ll be able to take iconic tracks from Dr. Dre’s first album, The Chronic, and his own Doggystyle, and port them into the web3-enabled creator economy in new and interesting ways.

Until next Thursday!

<$ Armand